How to Increase Your Tax Refund. The Canadian National Institute for the Blind provides support for the blind to assist them in increasing their independence.

Irs Federal Standard Tax Deductions For 2020 And 2021

Blind Persons Allowance is an extra amount of tax-free allowance.

Legally Blind Tax Benefits. Real Estate Tax Exemption. If you qualify for benefits for legally blind individuals under SSDI you will be allowed to work while on disability and earn up to 2040 per month in earned income as of 2019 without disqualifying yourself for blind disability benefits. The Tax Benefits of Being Blind.

1650 for single or head of household filers. Matt talks about how to get a tax deduction if you are legally blind. A person who is legally blind is eligible for an extra standard deduction on his or her Federal Income Tax.

For a blind person who makes 50000 annually medical expenses in excess of 3750 are eligible to be deducted from their taxes. 2600 for married couples filing jointly with two blind spouses. When filing tax returns a current Certificate of Blindness or other medical evidence may be required for verification purposes if an exemption or deduction is claimed.

If you and your spouse or civil partner are both eligible youll each get an allowance. Times the amount of taxes evaded by such fraudulent conveyance whichever amount is greater. In case any person entitled to such exemption has property taxable in more than one place in the State such proportion of such total exemption shall be made in each place as the.

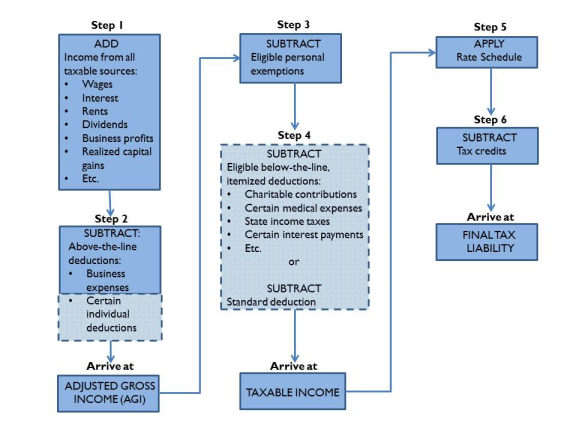

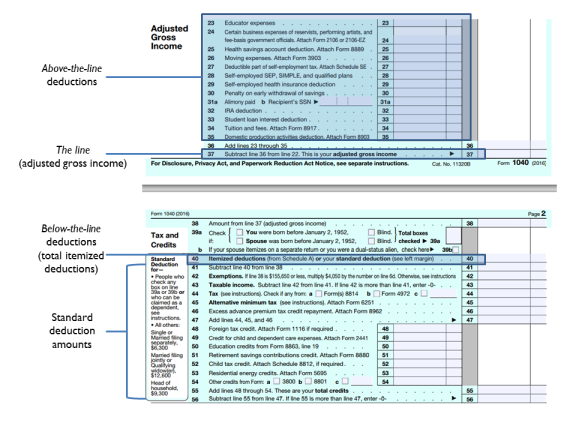

The lower tax liability comes from increasing either itemized deductions or the standard deduction depending on which the tax filer claims. Legal blindness entitles tax filers to a lower tax liability according to the Internal Revenue Service IRS tax code. The Bureau of Education and Services for the Blind will issue a Certificate of Legal Blindness on request to persons on the Agency Register.

You can transfer your. He is not giving tax. This Certificate can be submitted with the income tax forms as necessary proof of deduction.

Its not a functional low vision definition and doesnt tell us very much at all about what a person can and cannot see. For the 2020 tax year the legally blind tax deduction is. Legal blindness is a definition used by the United States government to determine eligibility for vocational training rehabilitation schooling disability benefits low vision devices and tax exemption programs.

Individuals who are legally blind may be entitled to federal and state income tax exemptions and deductions. 1300 for married couples filing jointly or separately with one blind spouse. Braille reading material is also considered a medical expense for.

The Canadian government also offers a Disability Tax Credit for Blindness to help with the expenses of special care and assistance to help blind people cope with the condition. It means you can earn more before you start paying Income Tax.

Https Cga Ct Gov 2015 Rpt Pdf 2015 R 0155 Pdf

/cdn.vox-cdn.com/uploads/chorus_asset/file/19650805/AdobeStock_314166542.jpeg)

Taxes 2020 When To File What Changes To Expect With Deductions Tax Breaks Chicago Sun Times

Work Incentives For People Who Are Blind Ticket To Work Social Security

Pin On Which 1040 Tax Form Should I Use For The Best Refund

Https Www Michigan Gov Documents Taxes Book Mi 1040cr 2 674636 7 Pdf

How To Apply For Disability Benefits For Blindness Disability Benefits Center

Special Deductions Available For Elderly And Blind Filers

Work Incentives For People Who Are Blind Ticket To Work Social Security

Irs Supplies Tax Resources For The Blind Visually Impaired

Social Security Disability For Legally Blind Americans

Legally Blind What S To Know About Irisvision

The Blind Deduction On The 1040 Tax Foundation

Tax Deductions For Individuals A Summary Everycrsreport Com

Tax Deductions For Individuals A Summary Everycrsreport Com

Social Security Disability Benefits For The Legally Blind Social Security Disability Benefits Social Security Disability Disability Benefit

Pin On The Franchise Enterprise

Financial Assistance For Persons Who Are Blind Or Visually Impaired Teaching Students With Visual Impairments